Volue Algo Trader Gas

Volue Algo Trader Gas provides automated market execution for utilities and traders engaged in gas trading. By integrating advanced out-of-the-box algorithmic trading strategies, customisability, and API connectivity, the solution empowers organisations to maintain a strategic focus in the gas markets while unlocking additional value from assets and flexibility.

Empowering gas trading excellence

Volue Algo Trader Gas is a SaaS solution designed to empower you with seamless and reliable automation in the competitive gas markets. Say goodbye to manual trading and hello to advanced execution strategies and analysis tools that harness the expertise of seasoned specialists with extensive market experience. With our gas algo trader, you'll gain an advantage in the world of gas trading.

Volue Algo Trader Gas is developed by our team of experts from the energy trading and capital markets. The know-how of our team covers quantitative analysis of the markets and generating trading ideas, to IT implementation and operation.

Market & data access

24/7 connectivity via Trayport Joule API to EEX & OTC-Markets ensures that you are always plugged into the market, ready to capitalise on emerging opportunities. Our solution also ensures that you have the historical data you need for in-depth analysis and informed trading decisions.

Plug-and-play simplicity in the cloud

Volue Algo Trader Gas operates as a Software as a Service (SaaS) deployed in the cloud, allowing you to start trading in production without the hassle of installation. Save time and resources and quickly gain operational efficiency in gas trading.

Customisable strategies

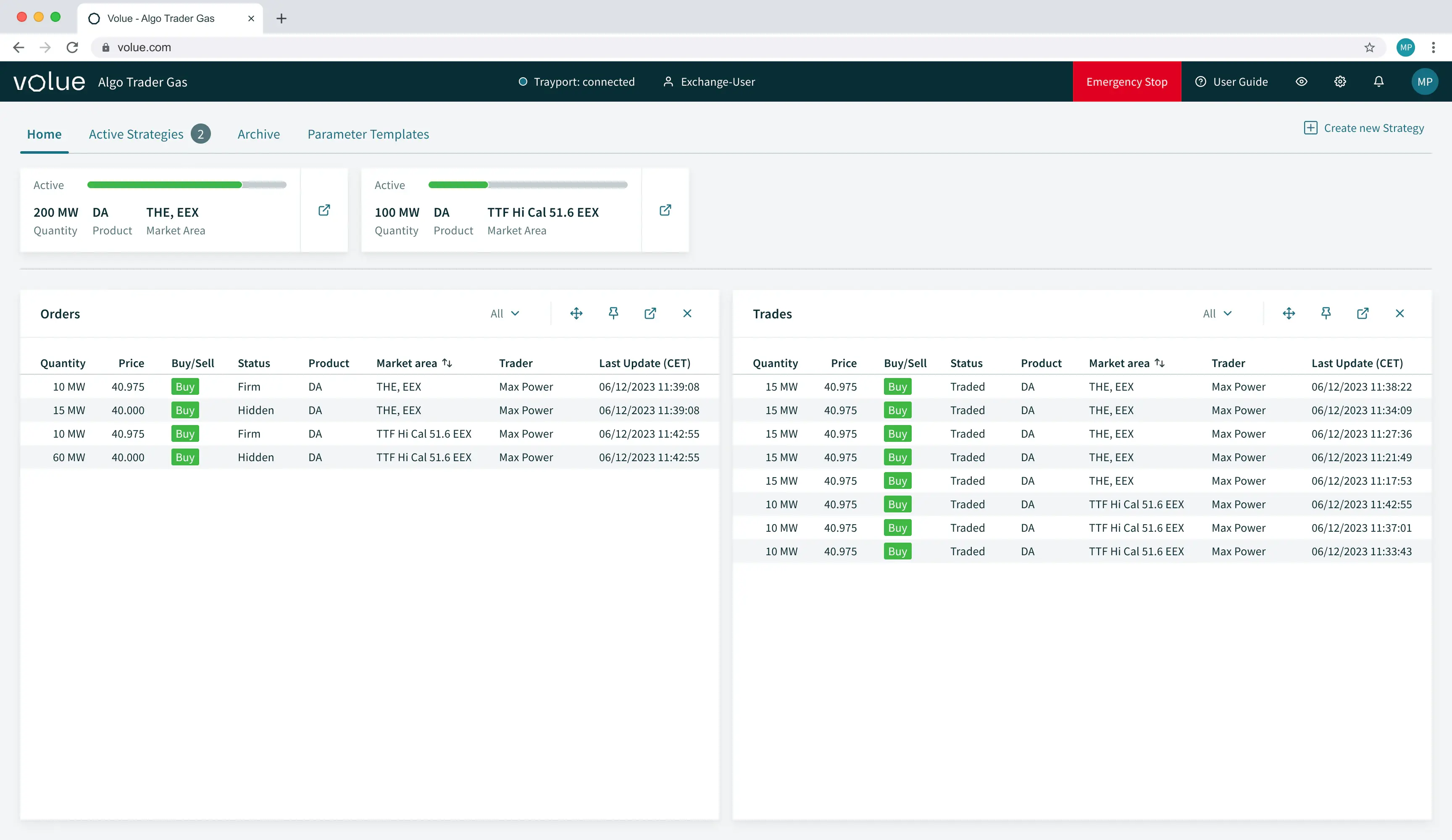

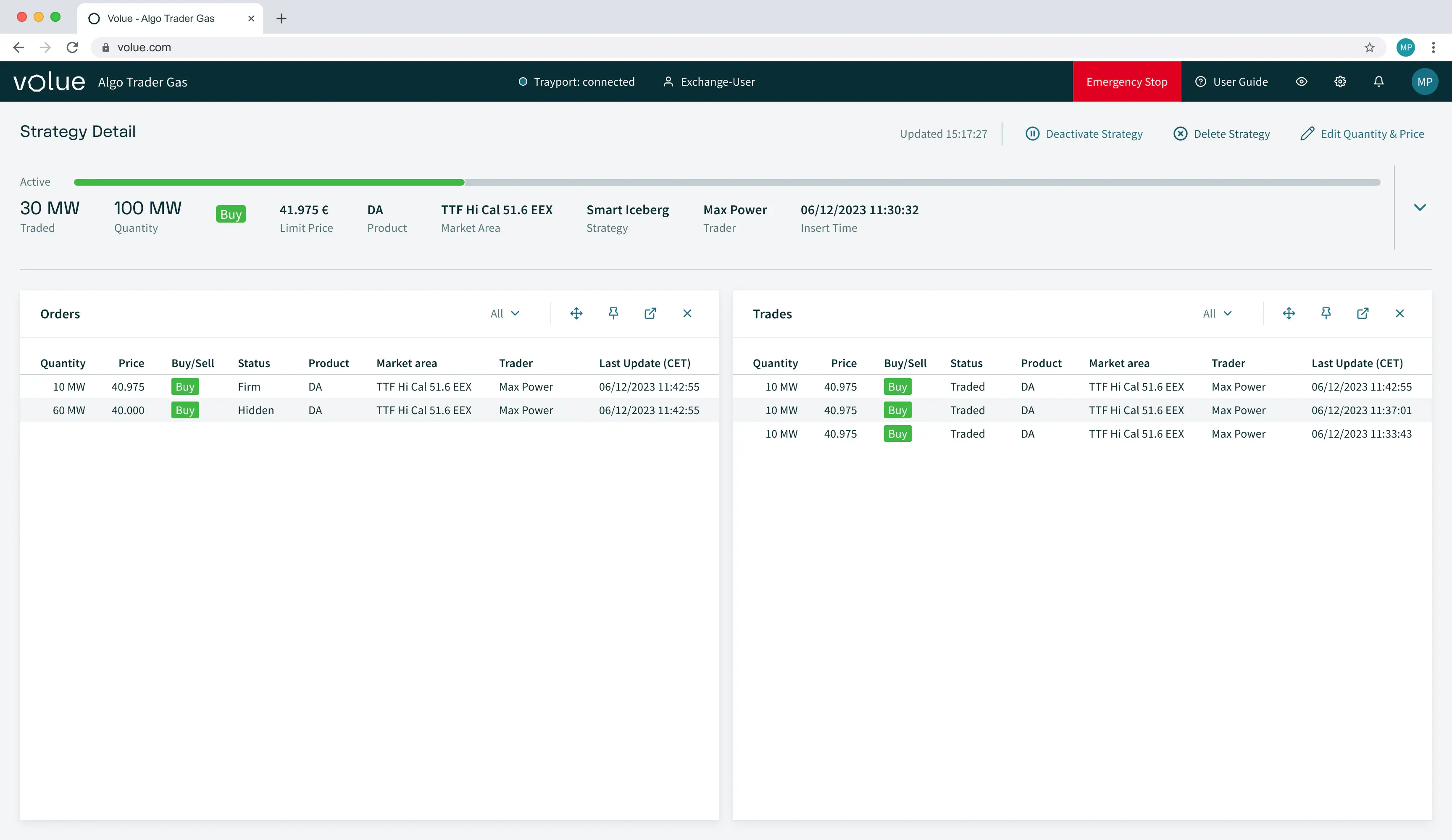

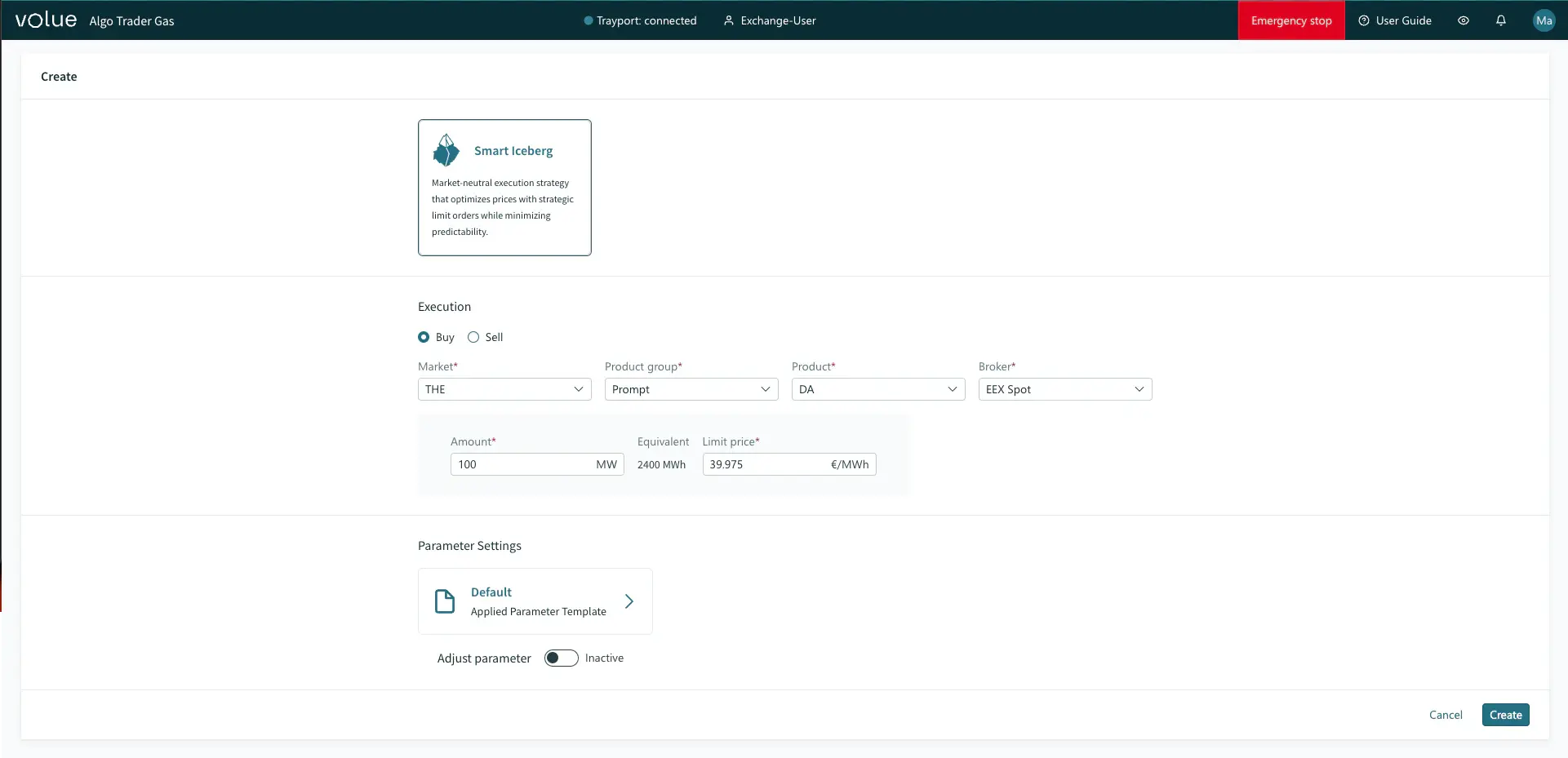

Customise your trading approach with parameterisable execution strategies. Whether it's deploying Smart Iceberg or Smart Spread strategies, the Volue Algo Trader Gas empowers you to trade with precision and flexibility.

Key functionality

- Trading process automation: Maintain a strategic focus while Algo Trader Gas takes care of routine trading tasks with precision and reliability.

- Customisable algorithmic trading strategies: Use proven out-of-the-box algorithmic execution strategies with granular parametrisation to maximise value

- Harness the potential of flexible assets: Monitor market conditions on defined opportunistic parameters and execute orders with minimal latency.

- Time and location spread trading: Trade flexibility via constant monitoring of market spreads.

- Algorithmic futures trading: Trade futures on OTC venues and forward/futures markets.

- Market access and data archive: Collect and storage of order books and trade history for specified market areas.

- Continuous development with seamless updates: Latest features and enhancements are always available, keeping your trading strategies cutting-edge.

- Built-in API access: Integrate Algo Trader Gas with your own trading landscape through REST API for seamless flow from trading decision to market execution.

- Dedicated customer success team: Volue's trading experts are committed to ensuring a successful onboarding and providing assistance whenever needed.

Explore the solution

Use-Case: Automated gas trading execution for gas-fired power plants

Use Case: Automated gas trading with Volue Algo Trader Gas

Frequently asked questions

We have completely redesigned Volue Algo Trader Gas to provide a fit-for-purpose and user-centric experience for gas trading. The new Volue Algo Trader Gas continues to incorporate the extensive knowledge and know-how from our trading experts in its trading strategies and operating logic.

Volue Algo Trader Gas is built for utilities, trading companies and industrials engaged in gas trading to fully and reliably automate market execution for gas contracts. The software scales from small-scale trading operations up to large daily volumes traded by expert users.

Volue Algo Trader Gas connects via Trayport Joule API to the EEX Spot and various OTC markets. We are continuously seeking to expand the market support.

Volue Algo Trader Gas is SaaS designed for effortless setup and operation. No installation or upfront investment is needed – the only prerequisite is existing market access through Trayport Joule. Our Customer Success team will guide you to your successful first trade after initial setup.

Volue Algo Trader Gas offers pre-defined execution strategies that enable users to start immediate and effective trading from day one. Currently, we support the Smart Iceberg and Smart Spread strategies, and will continue to actively expand the variety during 2024.

Yes. While the default configurations are designed to provide the best performance for most use cases, Volue Algo Trader Gas enables full customisation of the pre-defined strategies and your trading approach.

Yes. Volue Algo Trader Gas is equipped with a well-documented RESTful API. The API is ideal for automating market execution for trading decisions made in an external system.

Do you want to know more about Volue Algo Trader Gas?

Fill out the form and we will get back to you as soon as possible.

Arman Mohii, Solution Sales Expert