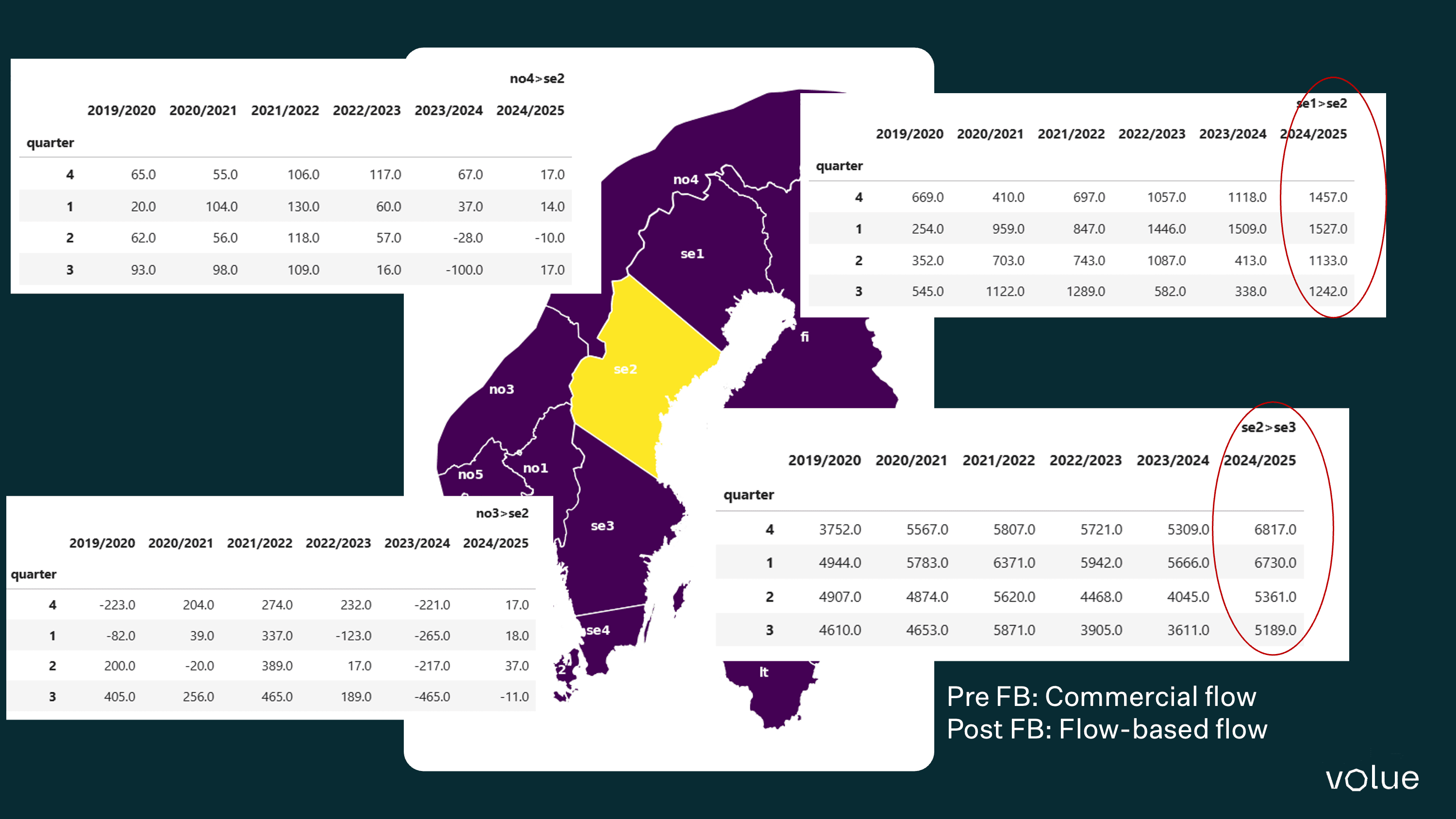

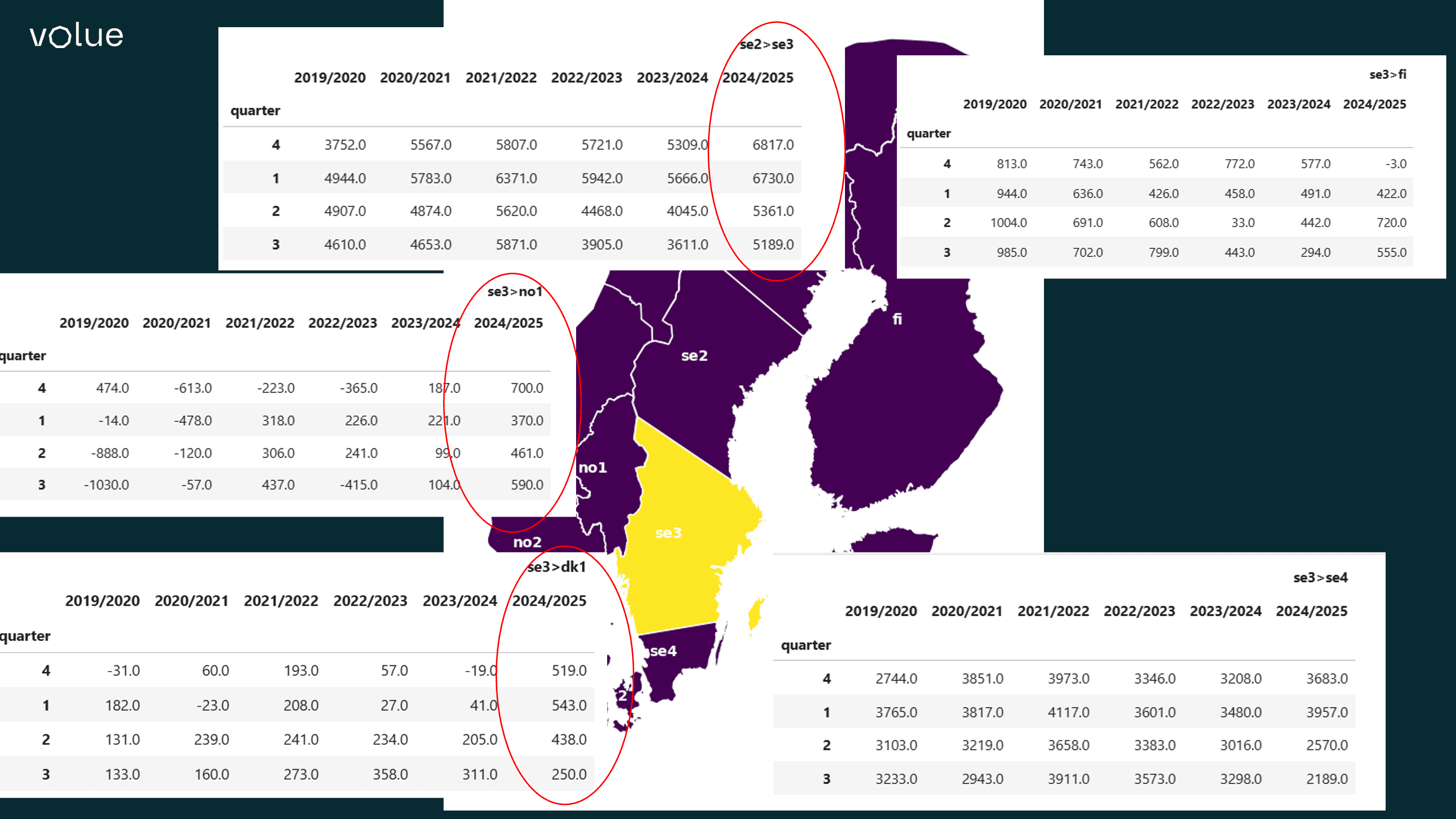

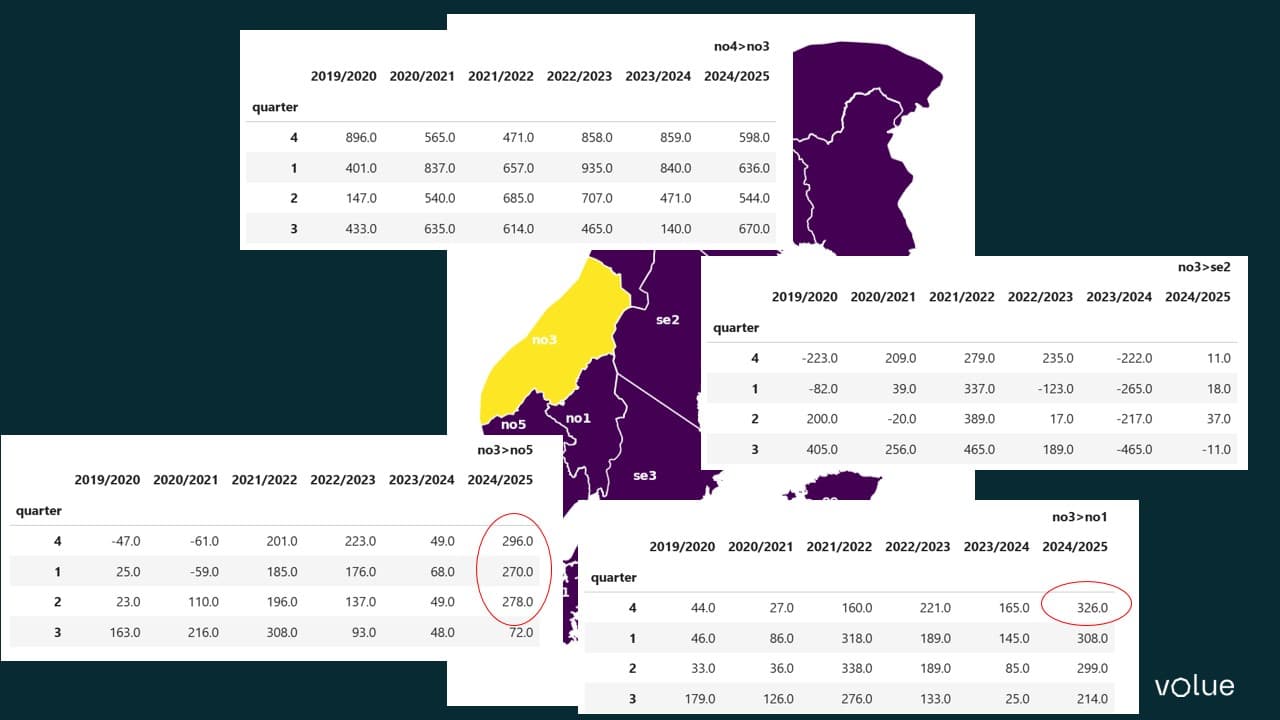

This week we celebrate the one-year anniversary of flow-based market coupling in the Nordics, and the examples above illustrate what kind of calculations are available to us now. The change in market clearing methodology has given us a richer and more explicit insight into the grid restrictions of the Nordic system, but also made the analysis more complex and challenging for many market players. Let us have a quick look back at the past year.

From Available Transfer Capacity [ATC] to grid-element restrictions

One of the biggest transitions from the ATC-world to flow-based market coupling, is to stop thinking of the power market from zone border to zone border, and start thinking about how an increase in production is distributed in a meshed grid, and how different flow impact on key network elements can explain price differences between zones. Many seasoned power market analysts have had to unlearn old instincts, and suppress the urge to look at flows and remaining capacities on the bidding zone borders.

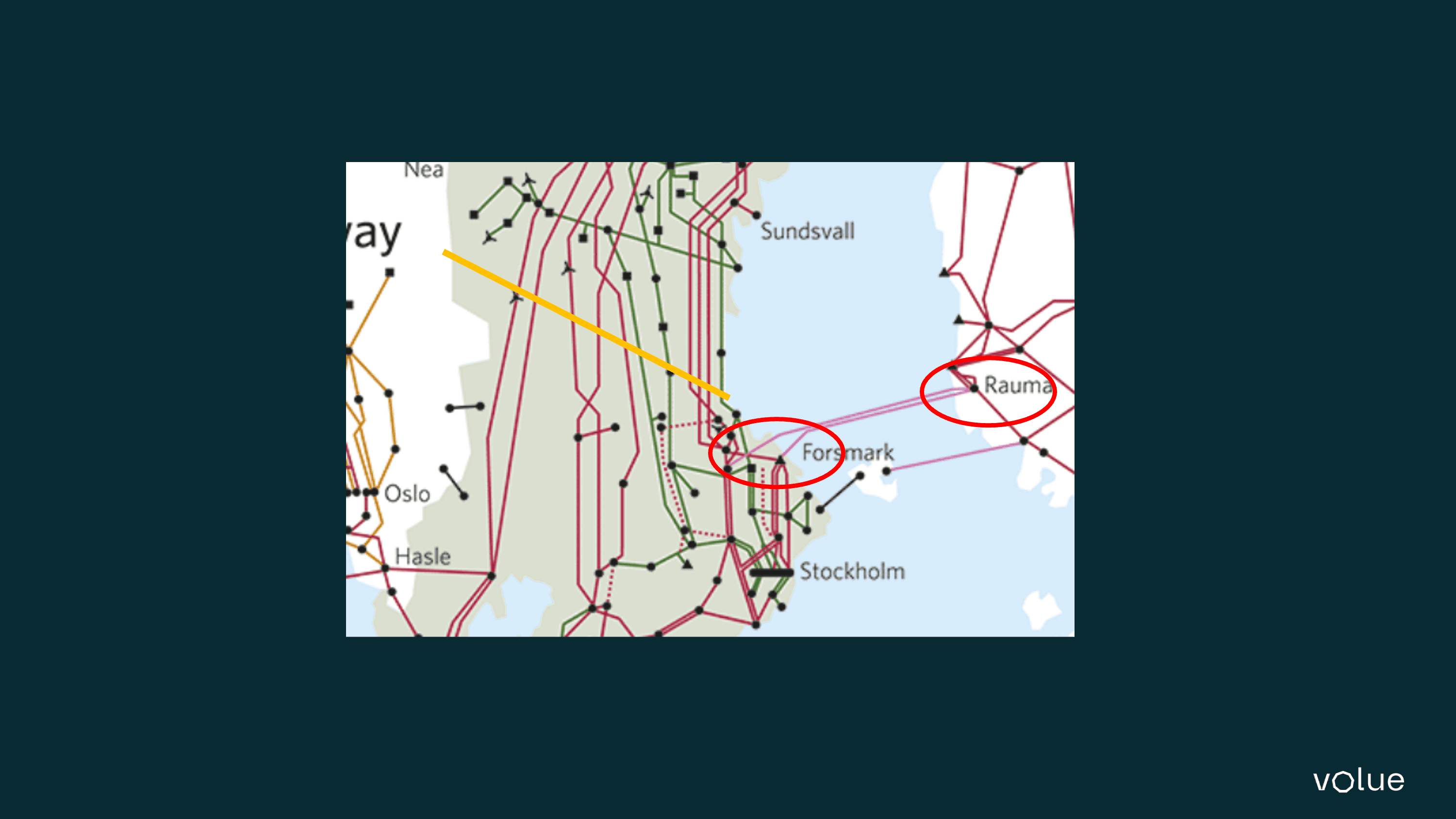

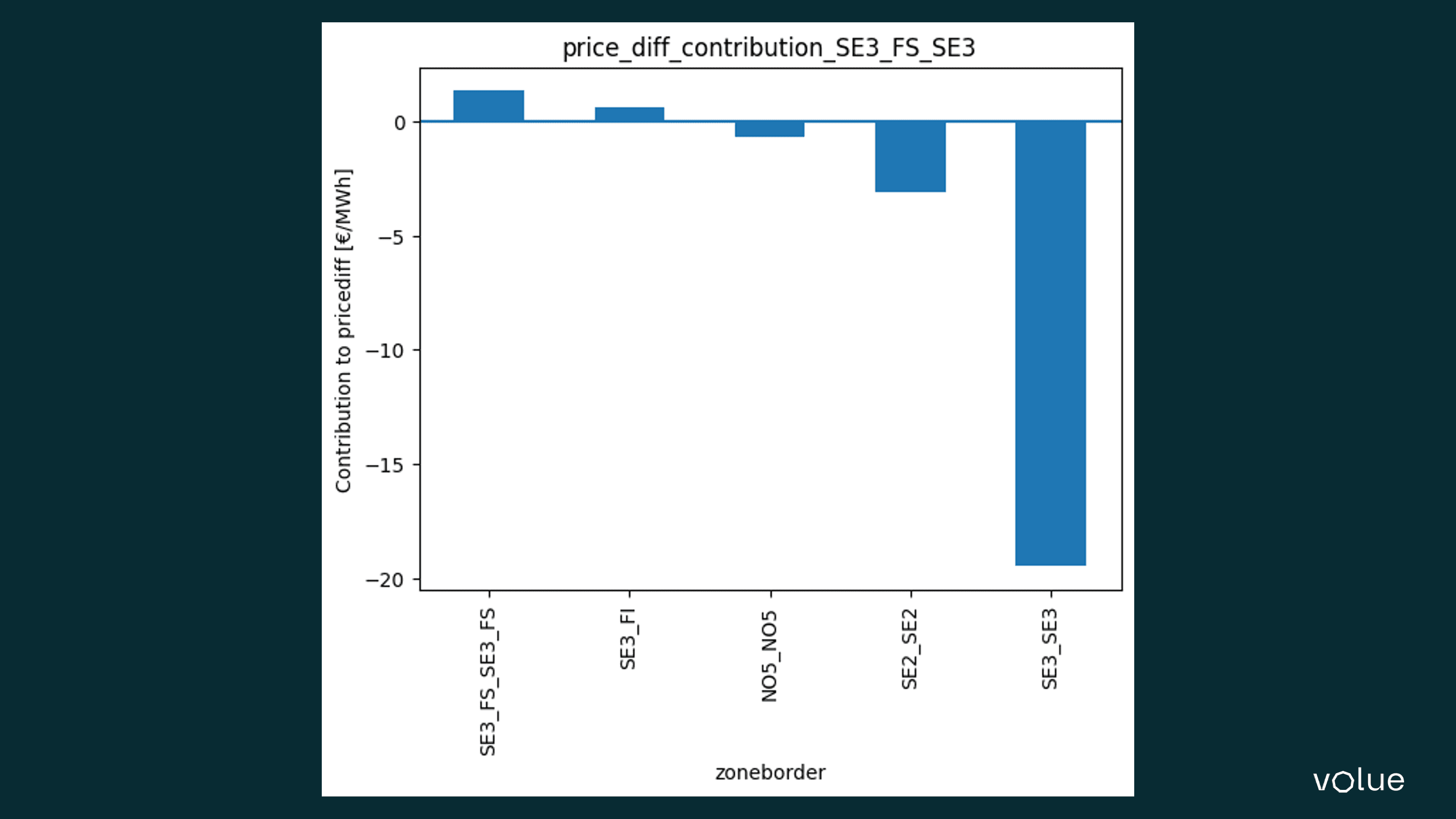

The beauty of the flow-based methodology is that the restrictions on the critical network elements (CNECs) are made explicit and transparent. In the ATC world, the TSOs presented capacities on the bidding zone borders, but the calculations behind these capacities were never revealed. In flow-based market coupling, the impact of each grid element is explicitly stated, and it enables us to calculate the impact of each grid restriction on any zonal price difference, as illustrated in the ingress. However, the price we have to pay is to move from a simple two-dimensional analysis to a 33-dimensional analysis in order to explain bidding zone price differences.

Another topic of unlearning in flow-based market coupling is the interpretation of commercial flows. In the ATC world, the flows on borders were key decision variables that determined whether there would be a price difference between zones or not. In the flow-based market coupling regime, commercial flow between zones is not a key decision variable and cannot be used to interpret price differences between areas. To understand price differences between zones, we must study differences in the power transfer distribution factors (PTDFs), which describe how increased production in one area will distribute across the meshed grid.

Have flows increased?

Part of the motivation to introduce flow-based market coupling was to exploit the existing grid capacity better, and to expose the transmission capacity more accurately to the day-ahead market. Therefore, larger flows from areas of surplus to areas of scarcity – such as larger flows North-South in Norway and Sweden, or East-West flows from Sweden to Southern Norway and Denmark in times of Swedish or Finnish production surplus – can be viewed as measures of success. However, since hydrology, consumption, wind production and fuel prices are constantly shifting, it is difficult to compare “apples to apples” when we try to compare post-go-live-flows to historical flows.

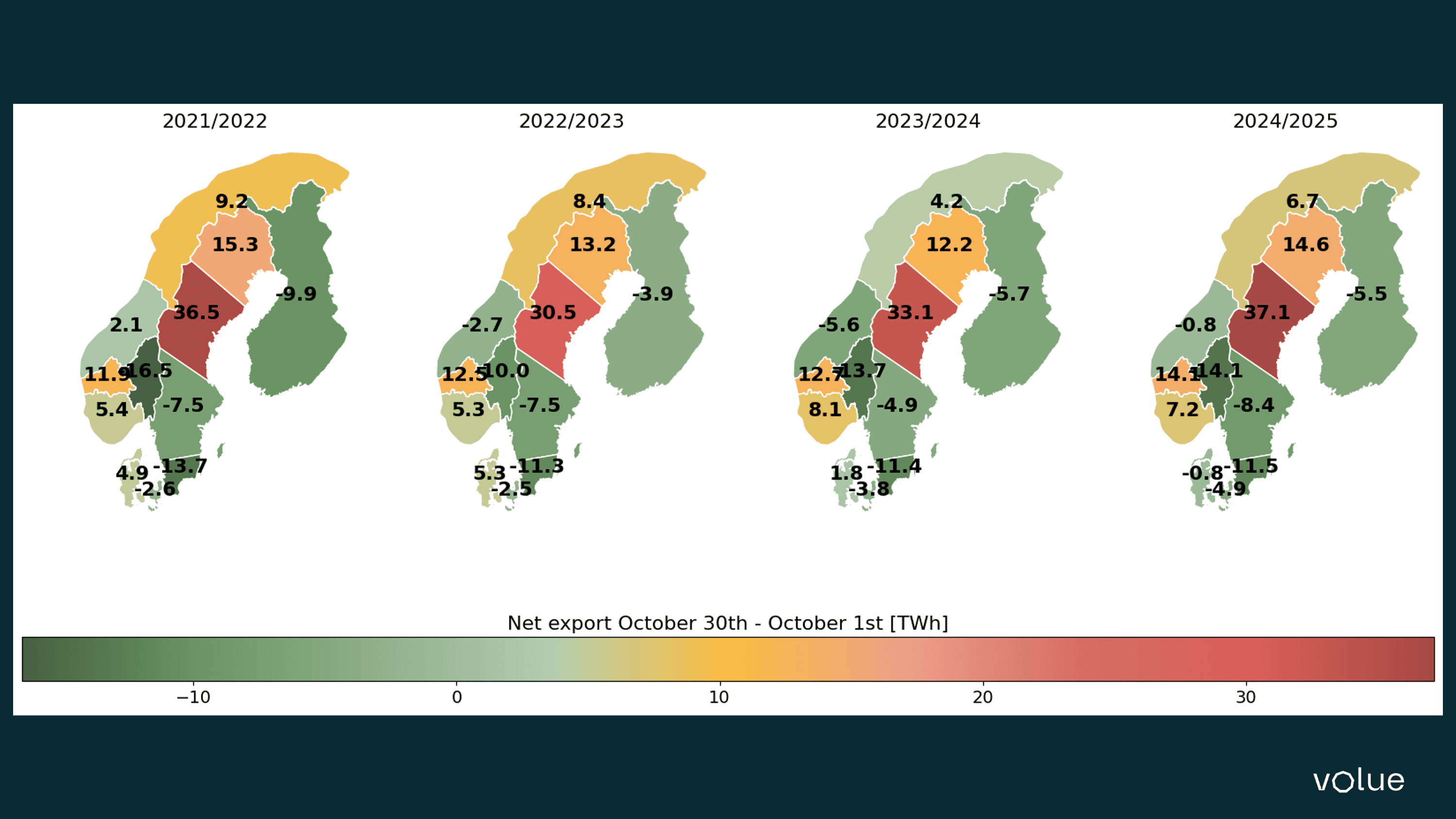

Starting by comparing net positions per bidding zone, it is clear that the total export from the four northernmost bidding zones in Norway and Sweden has been strong since the go-live. However, the sum of the net export for these areas was stronger in the year 2021/2022 than in 2024/2025, despite the fact that both years are characterised by large hydrological surpluses in the North, and a deficit in the South.